Banks came from the societal necessity to safely facilitate, safeguard, and transfer currency. During ancient times, cities were often raided. Instead of allowing their treasuries to be ransacked and pillaged, people opted to have their wealth kept safe in private establishments, which later became known as banks.

Before banks became a widespread institution, they were only available to a select, elite few. As currency and wealth became more widespread, banks opened their services to a wider audience.

Fast forward to today and many people are engaged in digital banking. The advent of digital banking came with both pros and cons that users should be made aware of as they directly impact their users’ finances.

What Is Digital Banking?

Digital banking is an umbrella term that involves performing all bank-related activities digitally from any location aside from a bank. Under this umbrella term is something called online banking, which is more specific to accessing bank features and services from your bank via a website or application.

When comparing the two, just remember that digital banking involves all facets of financial transactions that are done online, while online banking specifically references accessing bank services.

While computers were once the most popular way digital banking was accessed, the advent of more portable devices, namely phones and tablets, helped create the term mobile banking, which is just online banking but specifically done on mobile devices.

Pro: Ease Of Access

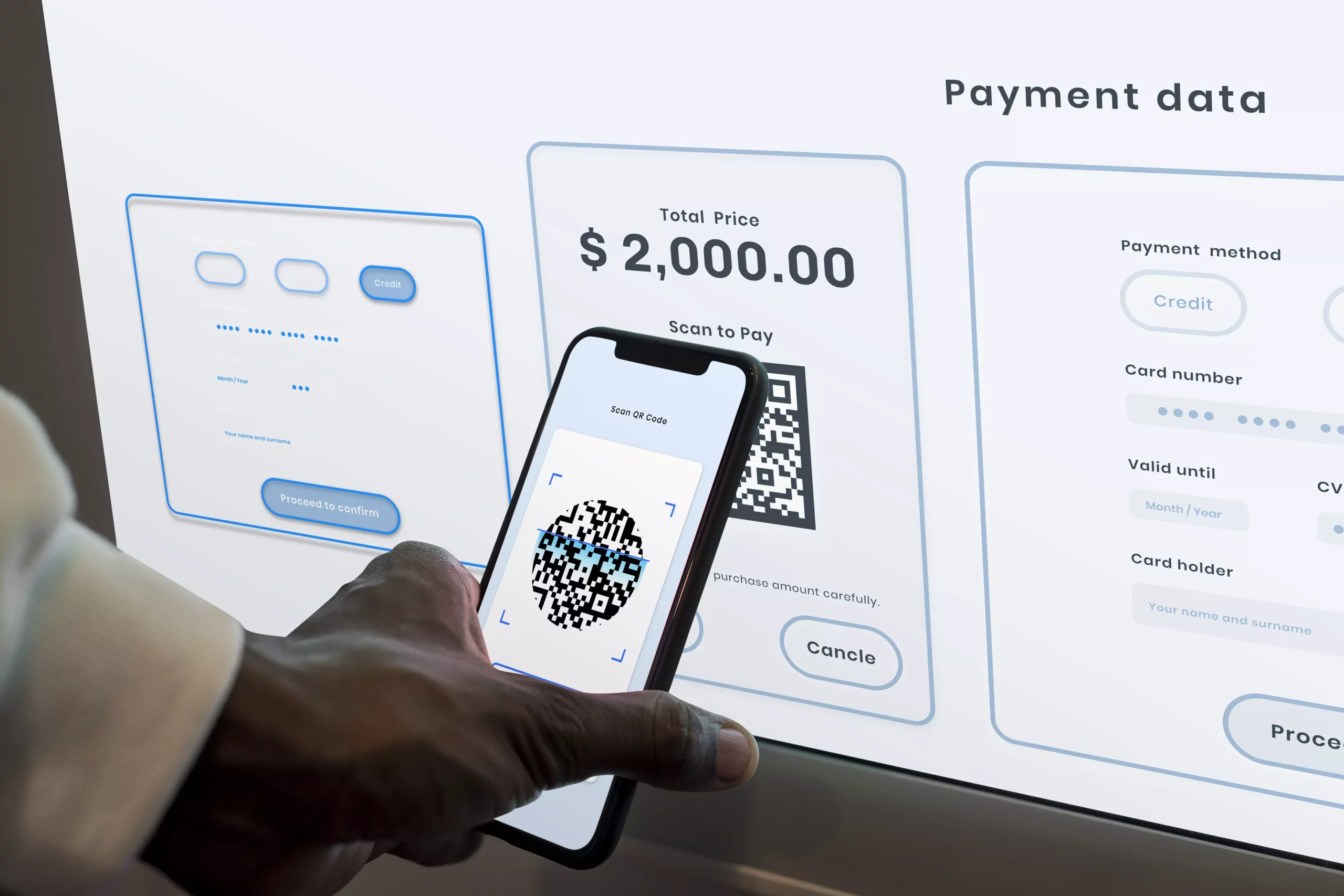

Digital banking brings a distinct convenience to its users. It allows users to move currency around without having to handle the physical fiat currency. This means you’re able to pay bills, give others money, shop online, etc., all from a device with online capabilities, such as a phone.

In line with giving others money, you’re able to transfer money to other parts of the world at record speeds. People no longer have to mail money to relatives or visit a remittance center, the ability to send money to family is literally at their fingertips.

Pro: Unlimited Oversight

Gone are the days when banking was dictated by the time of day. With every bank having their own app, customers can access their accounts and see their banking details at any time they want. The app doesn’t magically stop working once the bank closes because the servers that the information is hosted on, stay up 24/7.

Push notifications are also available to keep you updated on changes that happen within the app as well as your account. For example, when you make an online purchase, your bank will inform you that a charge has been made, keeping you apprised of ongoing changes in your account balance.

Pro: Security

Bank applications are secured by several layers of protection. From multi-step authentication, complex passwords, biometric authentication, and other more niche security measures, banking apps will keep your money safe and secure.

With the COVID pandemic, there was a big shift to contact-less interactions which made digital banking a more preferable option. This also made sure that the users were safe from infection as they didn’t have to expose themselves to others.

Con: Security

Even though the security on the application keeps your finances safe, there is still a big security issue with digital banking: you. You are your own biggest security risk.

From leaving your phone out and unlocked, sharing your password with other people, and clicking unknown links that are sent to you through email or text, oftentimes, it’s the user’s fault that their data has been compromised. If you can avoid shady links and sharing your devices with others, you shouldn’t have a problem with security.

Con: Usability For Less Tech Savvy Individuals

Generally speaking, newer generations of technology users will be more adept at using current technologies as they’re exposed to it on a daily basis. This means that people not exposed to newer technologies will have a harder time using them, simply because they aren’t as exposed to them.

This explains the stereotype that older people, particularly people like your grandparents, don’t quite understand how to make use of that cell phone you bought them.

Due to the lack of exposure and know-how, older people will elect to still go to physical banks, where a person can help them access their account. Better tutorials or physical classes will help usher more people towards using digital banking technology, but until then, brick-and-mortar locations will still need to exist.

Con: Customer Service Issues

In line with the previous con, customer service may at times be an issue. We live in a day and age where instant gratification is expected. With so many people needing customer service help due to issues with their accounts, these channels may, at peak hours, experience huge queues, leaving users waiting to be helped.

If you’ve ever worked a customer service job or have been made to wait to be helped, you’d know that irate customers do not mix well with long waiting times as this acts like an incubation period for their temper.

If you’re a patient person or if you’re able to resolve your digital banking issues by yourself, this won’t be an issue. For those who need to talk to an actual person to report a stolen card or a bad charge, you may want to prepare yourself for a wait, especially if you need assistance during working hours.

Con: Spending Money Becomes Too Easy

With instant access to your finances and the rising number of well-built eCommerce websites, it’s become too easy to spend money. For people with poor impulse control, this is a huge issue. A paycheck could potentially be blown long before the bills you need to pay are cleared.

Without the need to have physical cash and drive to various locations to shop, there’s nothing to really stop you from inputting your card information and buying that shiny new toy from Amazon that you really don’t need. Retail therapy, or the act of shopping in order to receive an instant dopamine boost, can help people get through their stressful week, but out of control, you could be spending thousands of dollars that you don’t have on items you don’t need.

The Wrap Up

Digital banking has helped make everyone’s finances more accessible. This comes with the ability to comfortably manage your money from the comfort of your home or literally anywhere in the world.

With more control of your finances also comes drawbacks that all stem from the user. If you’re a responsible person, none of these cons except the customer service should ever be a problem. For those of you who elect to partake in digital banking, stay responsible.